ABOUT MOBI¢INT

Mobile and Desktop services for financial institutions.

WHAT WE DO

Mobi¢int develops innovative mobile and internet banking software that keeps over 200 financial institutions ahead of the technology curve. These financial institutions have selected our platform because it has the features their users want, the security that financial institutions need and a commitment to technology that is required to remain competitive.

Mobile Banking Re-imagined

Providing a mobile and internet user experience (UX) is just the beginning. For successful implementations you need to understand your users and their demographics. This will assist you in providing relevant features and services in real-time. Mobi¢int allows you to view growth trend lines, returning number of visitors, geographic access, service penetration and flow.

Analytics and Reports You Can Count On

Smartphones and tablets have opened doors to new avenues for consumers to budget, shop and make payments. The number of consumers using mobile banking and mobile payments has steadily grown in the last 3 years. According to a report by Juniper Research, over 1 billion mobile phone users worldwide are expected to use their mobile devices for banking purposes by the end of 2017, up from 590 million in 2013. In today’s highly connected world, with expectations of convenient and instant access to relevant data, mobile is no longer just another channel, it should be part of your business strategy.

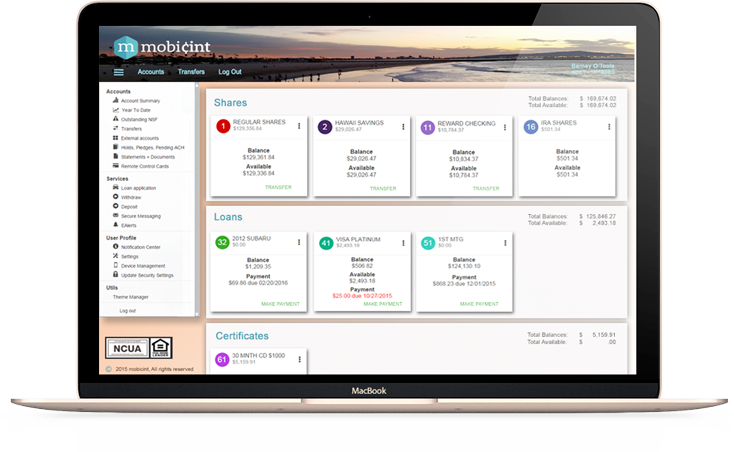

We’ve Reinvented the Desktop Banking Experience

Providing a mobile and internet user experience (UX) is just the beginning. For successful implementations you need to understand your users and their demographics. This will assist you in providing relevant features and services in real-time. Mobi¢int allows you to view growth trend lines, returning number of visitors, geographic access, service penetration and flow.

MOBI¢INT PRODUCT TOUR

Powerful Features

Account Management

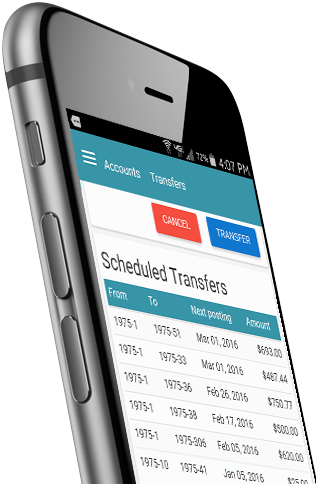

Real-time transfers, loan payments, cash advances and history.

Loan Application

Provide mobile and desktop lending. Reach your users on their terms.

Bill Pay

Allow users to access bill pay from within mobile and desktop banking.

eAlerts

Set account alerts based on balances, transactions and payment reminders.

Document View

Display account statements, receipts, loan forms and any other document type.

User Controls

Change username, password, email settings, account descriptions and manage active devices.

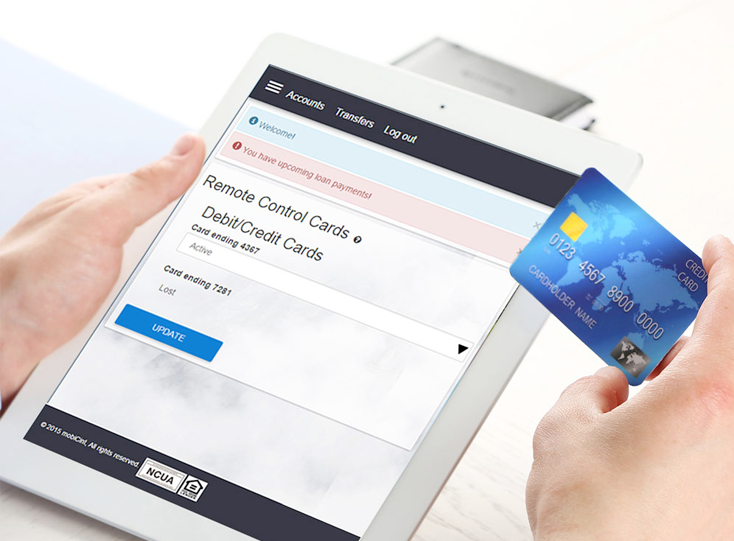

Remote Controls for Cards

Reduce fraud. Disable and enable debit and credit cards with the touch of a button.

Check Images

Allow users to view cleared check images.

Remote Deposit Capture

Provide an integrated RDC solution without the need for third-party applications.

Institution Transfers

Move money between financial institutions using a single platform.

ATM/Branch Locator

Built-in location services for ATMs, branch and shared branch locations.

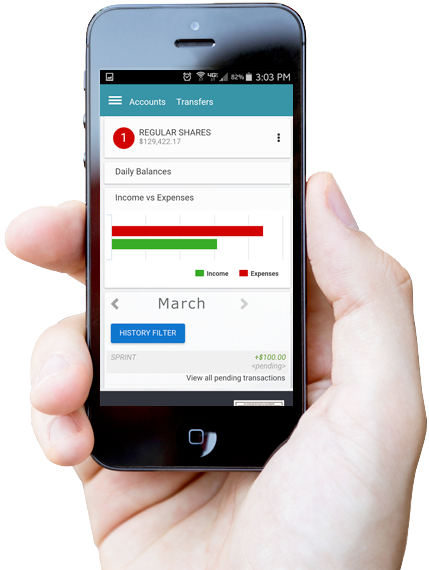

Income Tracking

Track income v. Expenses and rolling daily account balances visually.

Remote Controls for Cards

Reduce fraud. Disable and enable debit and credit cards with the touch of a button.

Check Images

Allow users to view cleared check images.

Remote Deposit Capture

Provide an integrated RDC solution without the need for third-party applications.

Institution Transfers

Move money between financial institutions using a single platform.

ATM/Branch Locator

Built-in location services for ATMs, branch and shared branch locations.

Income Tracking

Track income v. Expenses and rolling daily account balances visually.